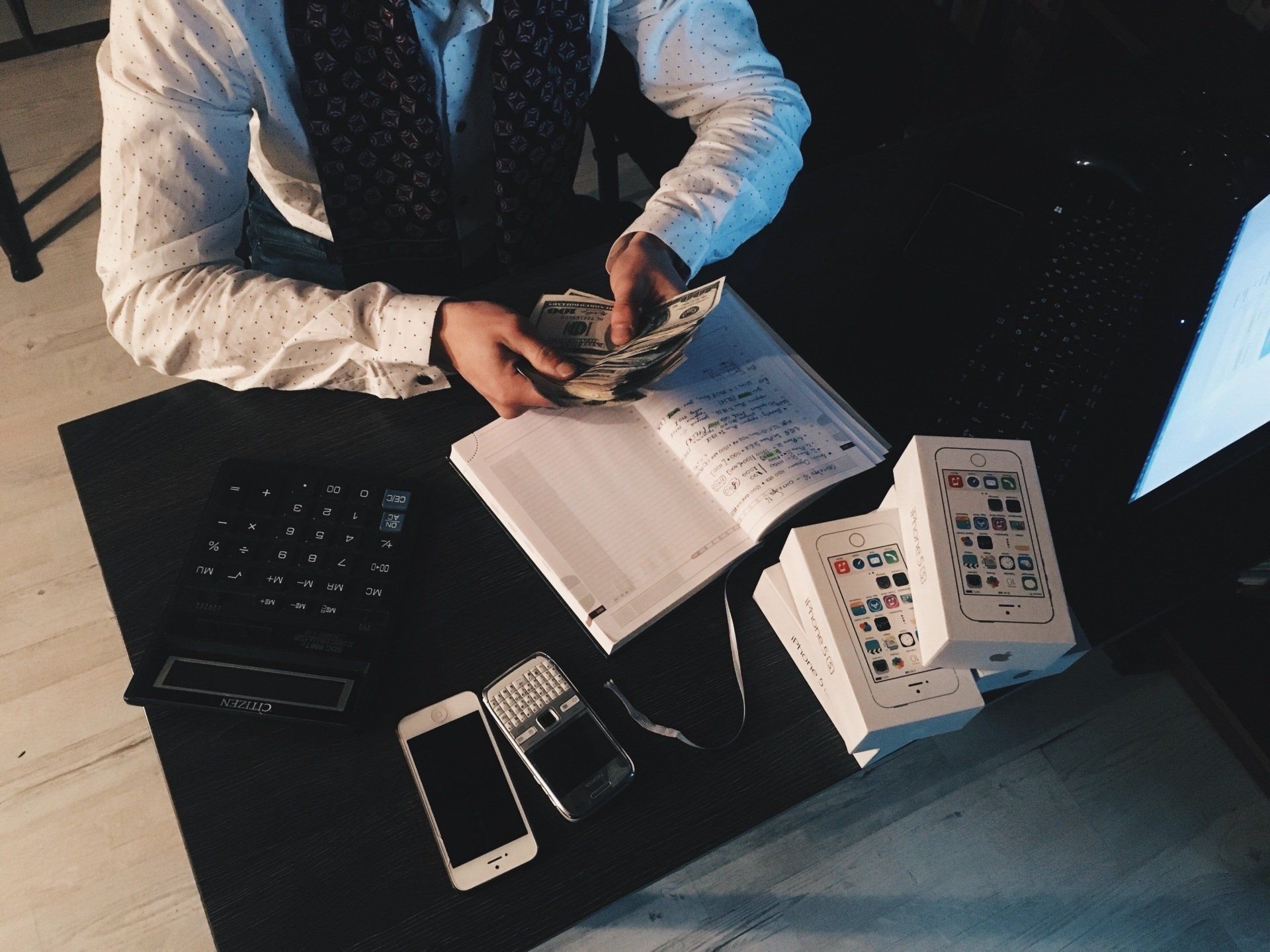

Making Money Feels Good,

Keeping it is your key to success.

The Importance of Proper Record Keeping for Mississauga Small Businesses

As a small business owner in Mississauga, you may feel like you have a million things to do and not enough time to do them. But there’s one thing that should always be a priority: proper record keeping. Keeping accurate records is not only essential for running your business effectively, but it’s also required by law. In this article, we’ll explore the importance of proper record keeping for Mississauga small businesses.

Helps with decision-making

Proper record keeping provides you with the information you need to make informed decisions about your business. By tracking your income and expenses, you can see where your money is going and identify areas where you can cut costs or invest more resources. You can also use financial statements to compare your business’s performance over time and against industry benchmarks.

Helps with tax compliance

As a small business owner, you’re required to comply with tax laws and regulations. Proper record keeping is essential to fulfilling these obligations. Keeping accurate records of your income and expenses makes it easier to file your tax returns and pay the correct amount of taxes. It also helps you avoid penalties and interest charges for noncompliance.

Helps with financing

If you need financing to start or grow your small business, proper record keeping is essential. Lenders and investors want to see that you have a solid financial track record and a clear understanding of your business’s financials. By keeping accurate records, you can provide them with the information they need to make informed decisions about lending or investing in your business.

Helps with audits

Audits are an inevitable part of running a small business. Whether you’re audited by the Canada Revenue Agency (CRA) or a private company, proper record keeping can help you navigate the process with ease. By keeping accurate records, you can quickly and easily provide the documentation requested by auditors and avoid penalties for noncompliance.

Helps with succession planning

If you plan to pass your small business on to a family member or sell it to a new owner, proper record keeping is critical. Potential buyers or family members will want to see a clear picture of your business’s financials, including its income, expenses, assets, and liabilities. By keeping accurate records, you can provide them with the information they need to make an informed decision about acquiring or taking over your business.

In conclusion, proper record keeping is essential for the success of small businesses in Mississauga. By keeping accurate records of your income and expenses, you can make informed decisions, comply with tax laws and regulations, secure financing, navigate audits, and plan for the future. If you’re not already keeping accurate records, now is the time to start. Consider using accounting software or hiring a professional accountant in Mississauga to help you develop good record-keeping habits and keep your business on track. By investing in proper record keeping, you’ll be setting your small business up for success.

© 2025 Dean & Associates is the operating name for Asad Dean, CPA Professional Corporation